If you log in to Bitget, pick a coin, and take your entry, the position panel will show up at the bottom of the screen.

And yes — the first number your eyes naturally lock onto is usually Unrealized PnL.

It looks like “my expected profit,” so when it grows, dopamine kicks in. But here’s the problem:

If you close (sell) a position by trusting Unrealized PnL alone, you can end up taking a loss.

Because in many cases, that Unrealized PnL is not calculated based on the price you can actually exit at right now. It is calculated based on Mark Price.

1) What Unrealized PnL Really Means on Bitget

Unrealized PnL is a “floating” profit/loss estimate while the position is still open.

But the key detail is this:

Unrealized PnL often reflects the result if you were to close at the Mark Price — not the real bid/ask you will hit when you close.

So if you’re trading tight ranges (like scalping) where a single tick can flip your PnL from plus to minus, you should be extra careful.

2) Mark Price: What It Is (And Why Exchanges Use It)

So… what is Mark Price?

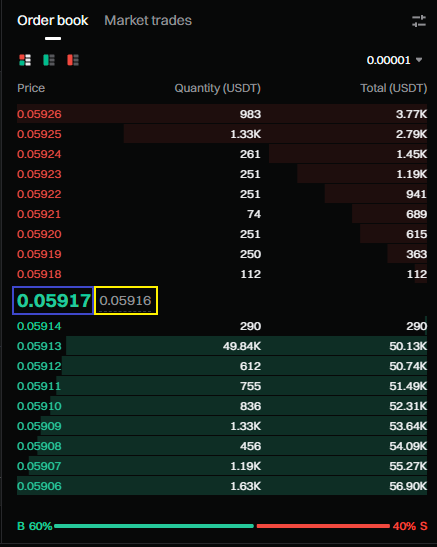

If you look at the order book area, you’ll usually see Mark Price shown as a separate price (often in a lighter color) compared to the last traded price.

Mark Price is not the last traded price.

It’s a reference price designed to help prevent unfair liquidations during sudden spikes, manipulation, or abnormal order book movements.

3) How Mark Price Is Calculated (In Simple Terms)

Mark Price is commonly derived from a combination of:

- Index Price: an average price collected from multiple exchanges

- Fair Basis / Funding-based adjustment: reflects the gap between futures and spot prices

In short, Mark Price exists so that people don’t get liquidated just because of a temporary “wick” or a manipulated spike.

This is a protection mechanism — but it also creates a gap between what you “see” and what you can “execute.”

4) The Price You Actually Exit At: Bid/Ask Matters

Here’s the practical point:

When you actually close a position, you don’t close at Mark Price.

You close at the market’s executable price:

- For a long (buy) position, closing happens through the bid side (you sell into bids).

- For a short (sell) position, closing happens through the ask side (you buy back from asks).

So if you’re about to close, the most accurate thing to watch is the bid/ask (or the close preview), not just Unrealized PnL.

Unrealized PnL is fine as a “quick glance” when you’re trading with room — but it should not be your only decision signal when precision matters.

5) One More Important Warning: Don’t Play Chicken With Liquidation

Even though Mark Price exists to prevent unfair liquidations, you still should not “barely survive” liquidation zones.

If you’re trading high leverage, isolated margin, or doing sleep trades with aggressive sizing, liquidation is not something you want to flirt with.

Because once it happens, a big chunk of your funds can disappear instantly.

If you want a practical approach to avoid throwing away around 30% of your capital in liquidation situations, check the post below:

Final Thoughts

If there’s one takeaway, it’s this:

Unrealized PnL is not always “what you will actually get” when you close.

When you’re about to exit — especially in fast markets — keep your eyes on the real executable price (bid/ask) and treat Mark Price-based Unrealized PnL as a rough reference only.